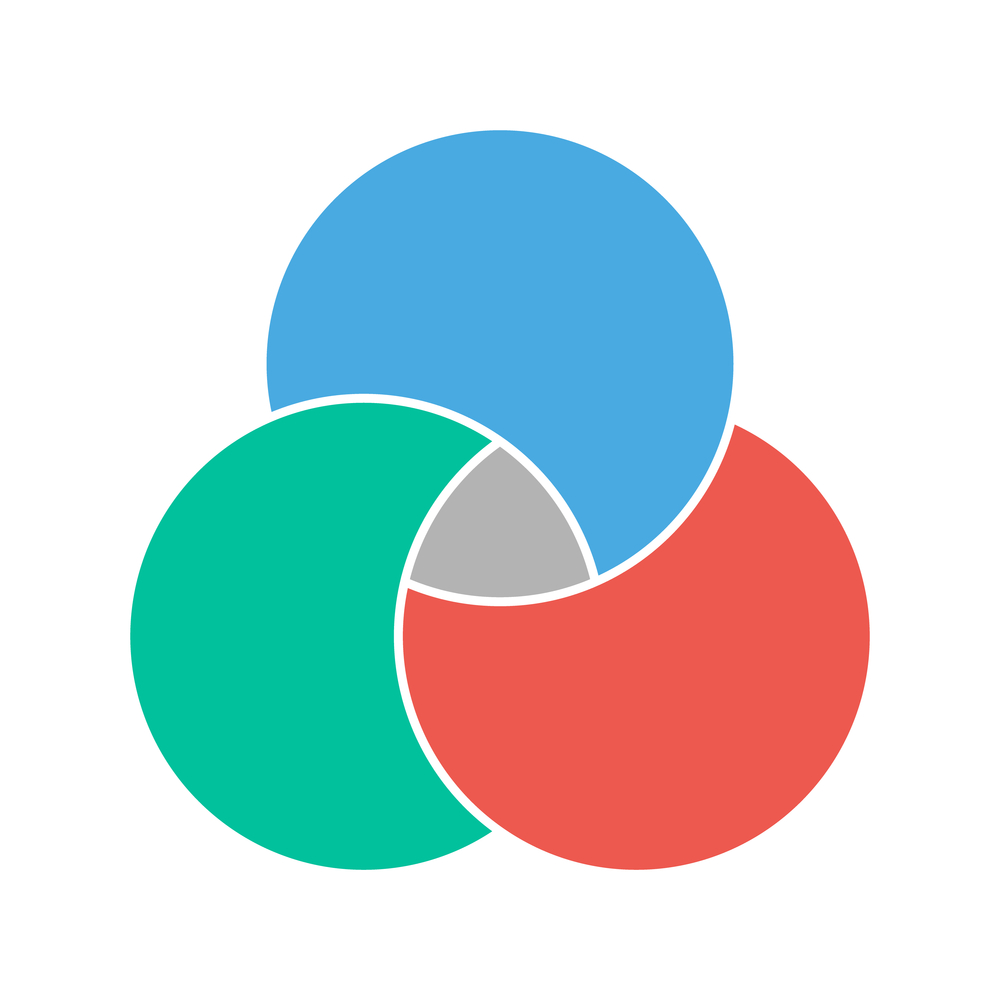

Ever thought about the skills you wish you’d learned earlier in life? Wondering which ones are truly paramount? Reflecting on my own experience, I’ve pinpointed three key areas: Data Science, Programming, and Personal Finances.

Each field is valuable in its own right. Yet, it’s when they’re combined that things get really interesting. This blend creates a powerful synergy that can greatly enhance both our professional and personal paths. Let’s dig deeper into these skills individually, and then examine the profound impact of integrating them.

Why should one learn Data Science skills?

Data are unique assets

Imagine data as a precious gem, unique and invaluable.

What makes it unique? Well, data can be both easy and challenging to gather, holding a tremendous potential for driving societal benefits, yet bearing the risk of misuse.

Given this special nature of data, we must master handling it effectively. We need to learn to govern, collect, manage, and analyze data, and deliver meaningful results. Due to its immense value, we aim to analyze data to enhance our understanding of the world. By doing this, we can make more informed decisions — decisions that are not just beneficial for us, but also for the people around us and the world at large.

Why specialized skills are key in handling data?

Picture a scenario where data are generated daily at a remarkable pace. They come in numerous structures, formats, and models. They come from various domains, each with its unique features.

Although there is an overwhelming amount of data available, some information can only be obtained through a meticulous and well-planned process of gathering. After obtaining the data, it must be cleaned, harmonized, pre-processed, and checked for quality before analysis can begin. This meticulous process can be time-consuming but is critical. Once the data is prepared, we need knowledge and skills to choose and apply the right analytical methods. Communicating the findings is the next challenge, presenting them in a comprehensible and actionable way for the target audience is the goal.

Data Science jobs are attractive and well-paid

Ever wondered why Data Science is often considered a lucrative career path?

Well, the answer lies in its high demand and value in the job market. In fact, on average, a Data Scientist in the US earns an impressive ~$124,000 annually on average.3

It’s not just about the money. Data Science roles have been ranked among the top 10 best jobs in the US for 2022, not only in terms of earning potential but also for job satisfaction and job openings!4

Perhaps these enticing factors contribute to why the role of a data scientist is often referred to as the “sexiest job of the 21st century” by the Harvard Business Review.5

Despite the ever-growing demand for data scientists, there is a considerable shortage of professionals in this field. According to the US Bureau of Labor Statistics, the employment of Data Scientists in the US is predicted to skyrocket by a staggering 35.8% from 2021 to 2031. This makes it one of the fastest-growing occupations in the country.6

Multiple Data Science roles are possible

Indeed, the realm of Data Science is vast and diverse, offering a plethora of roles for you to specialize in and truly make your own. Picture yourself as a Data Scientist, honed in on a unique area of expertise. You could also be seeing yourself as a Research Software Engineer, a Data Engineer, a Machine Learning Engineer, or a Big Data Specialist. Even envisioning a role where you manage and govern data might resonate with you. Yet, there’s no need to shift your career trajectory. Instead, you can supercharge it by mastering selected Data Science skills.

What makes Data Science skills so important?

Picture the potential of data to transform your career, business, or even your personal projects. In our information-driven world, skillful handling and analysis of data can be a decisive factor. Opportunities for data-informed decisions are all around us, replacing mere guesswork or hunches.

The data-focused approach is not just for corporations and institutions. It can improve your life and the lives of those around you. Making decisions based on solid data leads to more informed and superior choices.

Based on my personal experience, mastering Data Science skills propelled my career beyond my expectations. It opened doors for me to engage in intriguing research projects in academia, allowed me to publish my work in top-tier journals, and participate in international collaborations and conferences. Truly embracing data can expand your horizons!

Why should one learn Programming skills?

A recent analysis by the Polish Economic Institute reveals a pressing need for approximately 147,000 IT specialists in Poland alone. This demand is driven by the necessity to align the percentage of IT professionals in the labor force with the EU average. To reach equilibrium with the European Union, Poland requires a significant uplift in its IT sector. Currently, IT professionals make up only about 3.5% of all employees in Poland, which is significantly lower than the EU average of 4.5%. Despite a dynamic surge in the absolute number of IT sector employees in the past decade, this disparity between Poland and the rest of the EU has persisted.7

According to the US Bureau of Labor Statistics, there’s a remarkable prediction for a 26% surge in job prospects for Software Developers within the decade from 2021 to 2031. It positions this profession as one of the most rapidly proliferating vocations across the nation. A similar scenario exists for the Data Scientist role. Just think about how much your market value would escalate by acquiring skills from both of these occupations.8

The IT job market is constantly changing, influenced by various factors including pandemic crises and the rapid development of Artificial Intelligence (AI) technologies. Some even predict that advancements in AI could make programmers redundant which does not seem to be possible - although the mundane repetitive tasks will become more and more automated. However, consider a future where you have a strong set of programming skills, possibly enhanced by a deep understanding of Artificial Intelligence. This scenario seems more hopeful and promising than a future without any of those important skills.

Why should you learn Personal Finance skills as soon as possible?

Last, but certainly not least, we come to the third group of skills, which are Personal Finance skills. Arguably, these could be the most vital among the three. You may ask, why is this so? The answer lies in the reality that, even with a well-paying job, without a grasp of personal finance skills, you may find yourself living in constant fear of your financial future. By mastering these skills, you can instead enjoy financial peace and financial well-being, making the most out of your hard-earned income.

During my academic tenure, I was part of a research group studying financial health and literacy in Poland. The findings were not positive, reflecting a widespread issue globally.

Imagine being part of the 67% of Americans who, according to the National Financial Capability Study, are unhappy with their personal financial situation. It’s a daunting reality, isn’t it?9

The Economic Well-Being of U.S. Households 2022 report paints an equally concerning picture: financial well-being is on a downward trend. A mere 63% of adults claimed they could handle a sudden $400 emergency expense using cash or its equivalent. That’s a significant drop from the 68% who said the same in 2021.10

These financial woes tend to intensify with lower financial literacy. Individuals with underdeveloped Personal Finance skills are prone to overspending, insufficient emergency funding, and lack of retirement planning. They often have not even established any type of retirement account. The research underscores the immense value of personal finance skills and enhanced financial literacy. Indeed, these skills are not just beneficial but essential for financial stability and success.11

Europe’s situation is not much different, according to the OECD/INFE 2020 international survey of adult financial literacy. The survey reveals that nearly half of the adult population in the EU lacks an adequate understanding of basic financial concepts. While these figures are alarmingly low across the board, certain societal segments face a heightened struggle with financial literacy. The most vulnerable, including low-income groups, women, young people, and older individuals, are disproportionately affected. They tend to lag behind the rest of the population in their grasp of financial knowledge, signifying a critical area for improvement.12

Understanding Personal Finance is crucial for everyone. A common myth is that high income equals financial stability. However, even high earners can struggle with financial issues and insufficient retirement savings. Regardless of your current financial status, it’s essential to comprehend key concepts like cash flow, net worth, and savings rate. This understanding is particularly important if you aspire for Financial Independence or Early Retirement (FIRE). Even without these goals, the peace of mind and confidence gained from managing your finances well is rewarding on its own.

So, why should you consider learning these diverse skills simultaneously?

What magic unfolds when Data Science meets Personal Finance skills?

Utilize Data Science for your Personal Finances. Make choices based on solid data, instead of guesses. Use your financial analysis as a guide to see if you’re on the right path. Monitor personal finance metrics to see trends. Test what-if scenarios, predict possible results, and discover the exciting potential of financial freedom.

Imagine having the ability to deeply understand your personal finance data. Data Science gives you this power. It lets you answer your specific questions and modify the analysis to your needs. The result? A custom financial plan made by you, for you.

Your personal finance data is a great resource for learning Data Science. Exploring your own financial data introduces you to various data-related topics. This isn’t just theory, but practical experience with real-world data issues.

Pairing Data Science skills with a data-driven approach to managing your personal finances yields powerful results. It offers deep insights, constant tracking, and course adjustments. This not only enhances your understanding of your finances but also helps you make informed decisions toward financial freedom.

Envision a scenario where you’re not bound by the constraints of standard off-the-shelf personal finance software, where your financial analysis is customized to match your specific requirements and goals, offering a detailed understanding of your own specific situation.

How about combining Data Science and Programming skills?

Embracing programming in the realm of Data Science isn’t merely a choice, it’s a necessity. Think of it as the backbone that helps to ensure the reproducibility of your analytical scripts. But why stop there? Use your coding skills to automate complex data tasks and simplify manual workflows.

Integrating in-depth programming skills with your Data Science expertise can lead to a powerful transformation. Imagine metamorphosing from a Data Scientist with a bit of programming skills to a full-fledged Research Software Engineer.

Imagine the possibilities of building data products, automating pipelines, and crafting tools for non-technical users and Data Scientists. You can create reusable code libraries, design interactive dashboards, and generate automated reports.

Ever wondered why companies seek Data Science professionals with diverse software engineering skills? They need those who can build and release data products into production. However, Academia often doesn’t equip us with enough software engineering skills, causing difficulties in transitioning data prototypes into production-ready products. From my own experience in recruiting for various developer positions, I’ve found that locating a Data Scientist with robust programming abilities is consistently challenging.

Ever thought about merging Programming and Personal Finance skills?

At first glance, the intersection of Programming and Personal Finance skills may not seem immediately apparent. However, let’s delve deeper. Consider the sensitivity of your personal financial data. Are you truly comfortable entrusting them to a third party? Having the power to gather and analyse all your personal finance data independently, without the need to disclose it to anyone, is an enormous advantage for those who value their privacy.

Armed with programming skills, you will be equipped to automatically process your own bank statement history of transactions, automate repeatable analyses, and generate monthly reports. You’ll be adept at using open-source software, like my R package specially designed for Personal Finances, and even have the capacity to create your own extensions to it.

With programming skills, you’re not just managing your finances, but you’re leveraging the potential of your own data. You’re taking the reins, processing the data yourself, and transforming it into a form that’s ready for analysis. Ultimately, you will be able to code your own tools (financial or others) to be used in your job, business, or non-profit organization. This combination of skills empowers you to achieve more independently and more effectively.

Power trio: The dynamic synergy of merging Data Science, Programming, and Personal Finances skills!

Embark on a journey to master Data Science, Programming, and Personal Finance skills. These are not just separate skill groups, they combine into a powerful toolkit. This toolkit can trigger significant changes in your life and career.

Data Science skills enable you to solve complex data-related problems effectively. By learning Data Science, you not only enhance your problem-solving capabilities for your job or business but also broaden your career horizons in an exciting field.

Diving into the field of Programming allows you to extend your Data Science capabilities and potentially pivot your career. Such a move can open doors to opportunities that were previously out of reach. In an increasingly digital world, mastering programming skills could be your ticket to a successful career.

Personal Finance skills involve more than just budgeting or saving. They require an understanding of time value, financial management, and making informed financial decisions. Improving your financial skills can enhance your overall financial and business decision-making processes, increase your income (also thanks to Data Science and Programming skills), and improve your control over your spending. This could lead to more savings and profitable investments, putting you on the path to financial independence.

Now, you might be wondering, why go through the process of learning these skills independently, when you could combine them and reap remarkable benefits from all three? By mastering Data Science, Programming, and Personal Finance simultaneously, you can unlock an unprecedented synergy effect. This powerful combination can boost your current career, increase new career opportunities, improve your finances, and ultimately, transform all your life.

Footnotes

National Academies of Sciences, Engineering, and Medicine. 2018. Data Science for Undergraduates: Opportunities and Options. Washington, DC: The National Academies Press. https://doi.org/10.17226/25104↩︎

National Academies of Sciences, Engineering, and Medicine. 2018. *Data Science for Undergraduates: Opportunities and Options.* Washington, DC: The National Academies Press. https://doi.org/10.17226/25104↩︎

https://www.indeed.com/career/data-scientist/salaries↩︎

https://www.glassdoor.com/List/Best-Jobs-in-America-LST_KQ0,20.htm↩︎

https://hbr.org/2012/10/data-scientist-the-sexiest-job-of-the-21st-century↩︎

https://www.bls.gov/emp/tables/fastest-growing-occupations.htm↩︎

Łukasik, K., Strzelecki, J., Śliwowski, P., Święcicki, I. (2022), Ilu specjalistów IT brakuje w Polsce?, Polski Instytut Ekonomiczny, Warszawa.↩︎

https://www.bls.gov/ooh/computer-and-information-technology/software-developers.htm↩︎

https://finrafoundation.org/sites/finrafoundation/files/NFCS-Report-Fifth-Edition-July-2022.pdf↩︎

https://www.federalreserve.gov/publications/files/2022-report-economic-well-being-us-households-202305.pdf↩︎

Lin, J. T., Bumcrot, C., Mottola, G., Valdes, O., Ganem, R., Kieffer, C., Lusardi, A., & Walsh, G. (2022). Financial Capability in the United States: Highlights from the FINRA Foundation National Financial Capability Study (5th Edition). FINRA Investor Education Foundation. www.FINRAFoundation.org/NFCSReport2021↩︎

https://www.oecd.org/financial/education/oecd-infe-2020-international-survey-of-adult-financial-literacy.pdf; https://finance.ec.europa.eu/consumer-finance-and-payments/financial-literacy_en↩︎